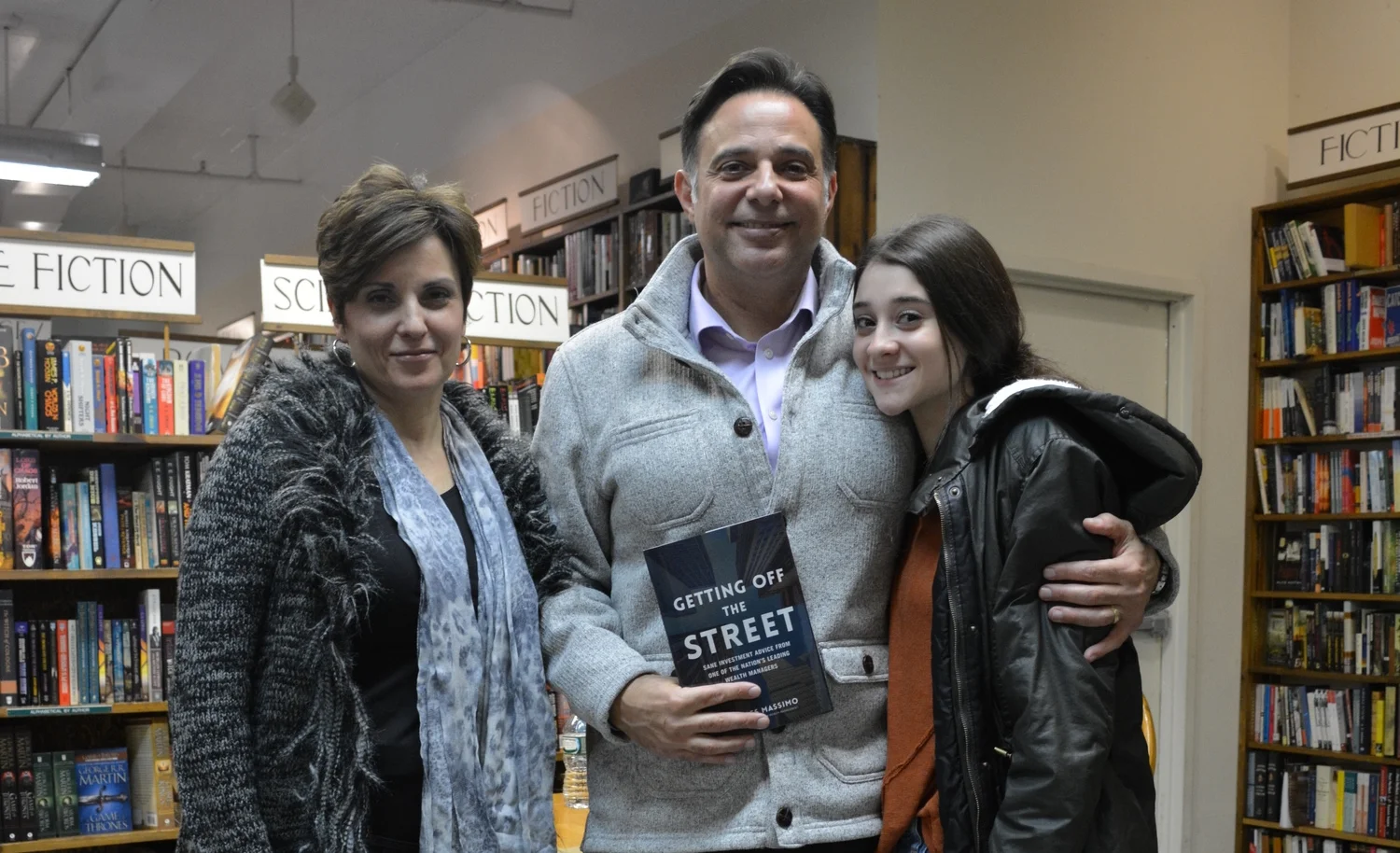

Author Talks About ‘Getting Off The Street’

/One of many who realize that the Wall Street environment is not the environment in which they belong, Charles Massimo left Wall Street in the early 2000s to create his own Deer Park-based investment firm.

His debut book, called “Getting Off The Street – Sane Investment Advice from one of the Nation’s Leading Wealth Managers,” is less about his physical escape from Wall Street, and more about an escape from the attitudes and motivations of typical Wall Street money managers.

“Investing should make you feel empowered,” he said at a Monday night book signing in Huntington.

Massimo stood in front of an audience of about 25 and explained why he decided to leave Wall Street.

He had entered “the business” in an effort “to make a difference in people’s lives,” he said. When he realized that he was not doing that at other firms, he decided to start his own.

“I think when I was graduating college, pretty much everyone said, ‘You’ve got to go to Wall Street to get a job,’” Massimo told Long Islander News before the signing. “I went there at the direction of kind of where the economy was at the time; where people were going was Wall Street… I was too young to understand too much more of it at that time.”

He arrived in the financial district in 1984 and, today, can say that he has been “in and around Wall Street” for nearly three decades.

While on the street, he watched as firms gave clients advice that he knew was not in their best interest.

“I found that a lot of the advice that many clients get are just really kind of hype and misinformation,” said Massimo, of East Setauket. “A lot of the time, the advice they get is geared more toward helping the firm make money.”

There is conflict, Massimo explained. “Are they recommending their product because it makes money for the firm, or are they recommending the product because it’s truly in the best interest of the client?”

“Unfortunately, too many times, the firm comes before the client,” he said, noting that he was trained to make money for the firm and rarely found himself in discussions about the client’s interests.

Now a veteran of the Street, Massimo is telling those who read his book that there are a few ways to make investing simple. First, he says, it is important that each investor focus on his or her own behavior.

“Like anything in life, if you behave badly, your returns are going to be bad,” he said.

Then, he says, investors much focus on things that are under their control.

“We can’t control the directions of the market or the economy… but [what] you can control is how much you pay for your investment advice, how well you diversify your portfolio, and how you allocate assets within your portfolio.”

Many, he said, try to time the market or find the next Google – strategies that he said most often prove unsuccessful.

“I’m just really trying to get to the audience to kind of help them get through all that clutter that’s out there and all the things that they hear,” he said. “And create a very simplistic approach to investing.”

Investment is not about having money, he explained; it is about “discipline and habit,” constantly putting away small increments and gradually building up to amounts that might someday yield profit.

“I think the first thing is just start, just do it,” he said. “Don’t worry about the particulars of how to do it; honestly, I would just do it, as much as you can now… it’s amazing how much money accumulates.”

Meanwhile, some of the money that Massimo accumulates from book sales will be turned into investment of a different form. The father of 15-year-old triplets – two boys and a girl – said that he will donate some of the money to not-for-profit Pal-O-Mine Equestrian, which offers a program for individuals with disabilities. His two sons are on the autism spectrum, he said, so he is “very close” to Pal-O-Mine.

He will also donate some of his profits, he said, to the Choroideremia Research Foundation, Inc. – a foundation that researches the retinal degenerative disease that has affected two sons of a longtime client of Massimo’s.