Cat Shelter Operators Get The Boot

/Long Islander News photo/David Weber

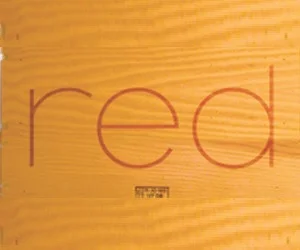

The Town of Huntington is cutting ties with the League of Animal Protection, which operates the Grateful Paw Cat Shelter in East Northport, above.

By Jano Tantongco

jtantongco@longislandergroup.com

The Town of Huntington is cutting ties with the League For Animal Protection of Huntington, which operates the Grateful Paw Cat Shelter in East Northport, according to Huntington Supervisor Frank Petrone.

The decision was not made “lightly” or “without significant fact-finding” but came after town officials learned that LAP lost its tax-exempt status, Petrone wrote in a May 26 letter that was released to Long Islander News. The loss of the status was discovered as the town was working on a renewal contract with LAP when a resident notified the town that he had incurred a penalty with the IRS for claiming a tax-deductible donation.

Petrone added that the town confirmed with the IRS that the organization has not filed its federal Form 990, nor its CHAR 500 with the New York State Attorney General’s Charities Bureau.

“Even under the best case scenario, this is not a situation that can be resolved quickly, so the town felt it was compelled to sever ties with LAP and seek another operator for the cat shelter,” Petrone wrote.

The IRS automatically revokes tax-exempt status for organizations who have failed to file for three consecutive years. LAP’s was revoked on May 15, 2015, records show.

LAP President Deborah Larkin stated in a May 18 letter that was available to the public that the nonprofit’s accountant “without offering any excuse, for whatever reason” did not file the forms. She added that Bohemia-based accounting firm Cerini and Associates LLP has been retained and is working on getting LAP’s status reinstated. Larkin said she has been told “there is no impediment to the reinstatement.”

“The responsibility to make certain that the appropriate forms were filed with the taxing authority to maintain our not-for-profit status was ours,” Larkin wrote. “We are mortified, apologetic and obviously saddened for letting this happen. So, to the Town of Huntington, our loyal volunteers, donors, followers, and fellow pet lovers, we offer our humble apology.”

LAP’s former accountant, East Northport-based Kenneth Denker, did not respond to a call for comment before Wednesday’s deadline.

Barbara Cozak, director of Grateful Paw Cat Shelter, took issue with the Petrone’s claim that reinstating the tax-exempt status would be a lengthy process.

“They have a bug in their bonnet,” she said. “We’re trying to get the residents behind us now, we have a good reputation. It’s all run by volunteers, and we’re all getting pretty old. But, we persevere.”

The cat shelter must be vacated by July 19, according to town spokesman A.J. Carter. Operations at the town’s dog shelter will not be affected.

LAP is free to take any cat from the shelter, and the town will care for any remaining cats until a new operator is found, according to Petrone’s letter.

The town has issued a request for proposal for another tax-exempt nonprofit to run the shelter.

If LAP recovers its tax-exempt status, Petrone stated in his letter, “nothing will preclude it from submitting responses to future RFPs.”